Indian Stock market – US Federal Reserve chair Powell signals persistent tight policy until inflation reaches 2%, following recent higher than-expected inflation data. Market experts suggest potential selling pressure in equities, affecting emerging markets like India. Due to their rich valuation and expectation of moderation in earnings growth in Q4 FY24, mid and small cap indices also witnessed a strong sell-off.

US Federal Reserve Chair Jerome Powell stated late on Tuesday that there has been a lack of further progress so far this year on returning to our inflation goal. He indicated that a tight policy is likely to present until inflation trends consistently move closer to 2%. Powell’s comments mark a change in his stance following a third consecutive month in which a key inflation measures exceeded analyst predictions.

The rapid decline observed at the end of last year, he suggested that the Fed might maintain rates at their current levels “for as long as necessary” if pressures endure while pointing to the absence of further progress on inflation. As per “The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence”, Powell said Tuesday in a panel discussion alongside Bank of Canada Governor Tiff Macklem at the Wilson Center in Washington, as reported by Bloomberg News.

During March, the US retail inflation print jumped to 3.5% on an annual basis, against the expected of 3.4%.It showing that consumers continued to spend at a faster pace than anticipated despite borrowing costs at a 23-year high, while the recent U.S. retail sales also jumped 0.7% month in March 2024, surpassing forecasts of 0.3%. Since March 2022, the U.S. central bank has raised its policy rate by 525 basis points to current 5.25% to 5.50 % range.

Market experts suggest that Powell’s remarks could trigger additional selling pressure in equities, particularly in emerging markets like India. The delay in rate cuts has unsettled investors, especially after the US March inflation data was released last week, prompting a shape sell- off in Indian equities. In addition to the delayed in the rate cuts, escalating tensions in the Middle East, a surge in US bond yields, the rupee hitting new lows against the US dollar, and selling pressure from foreign institution investors (FLLs) have all added to the downward pressure on Indian stocks.

More about Indian Stock Market

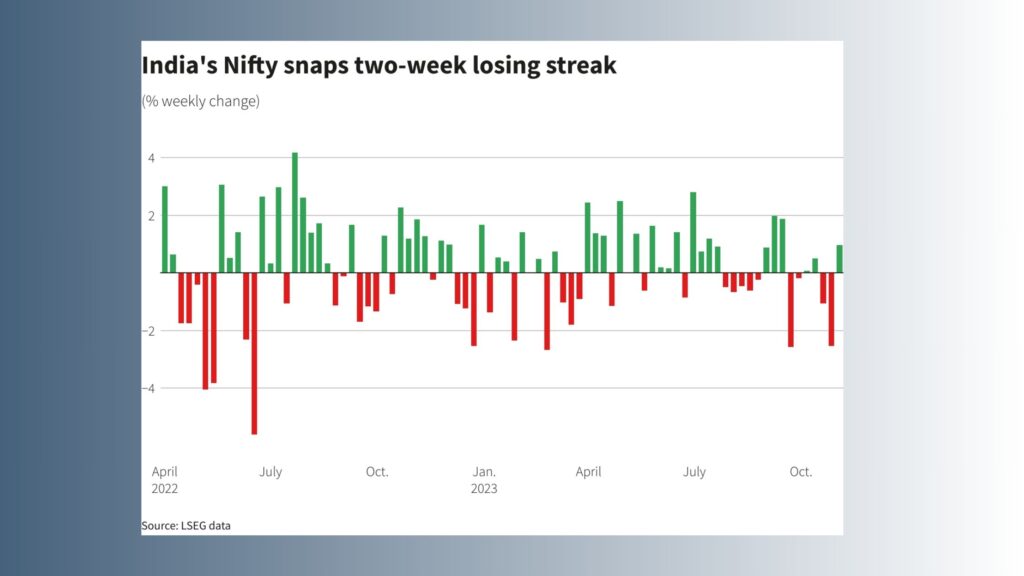

Among the hardest hit in this market downturn were IT stocks, witnessing declines ranging from 2% to 6%, amid this backdrop, both benchmark indices Nifty 50 and Sensex have experienced declines of 2.65% and 2.79% appropriately, in the last three sessions. Notably, the Nifty IT index emerged as the most affected sectoral index, recording a nearly 5% decline over the past three sessions, with expectations of prolonged rate hikes potentially reducing client spending. Further, the mixed results from IT giant Tata Consultancy Services have dampened investors sentiment towards IT stocks.

Follow us for more details http://www.caffee-story.com

Due to their rich valuation and expectations of moderation in earnings growth in Q4 FY24. On the other hand, mid and small cap indices also witnessed a strong sell off. Since April 12, FIIs have offloaded 15,763 crores on the rise in US bond yields. On Tuesday, foreign institutional investors (FIIs) emerged as net sellers in the capital markets, offloading shares worth Rs 4,468.09 crore, as per exchange data.

Table of Contents

According to market experts, the rise in US bond yields could prompt investors to reallocate their funds from riskier assets, potentially triggering more capitals outflows from equities in favor of higher- yielding bonds.